Together we’re creating Australia’s Best Platform

Empowering better financial futures, together.

We’re committed to delivering innovative solutions that cater to the diverse needs of your clients, regardless of their investment complexity. By leveraging our expertise in managed portfolio technology, SMSFs, and high-net-worth investment capabilities, we’re empowering you to support a broader range of client segments – all on Australia’s Best Platform.1

Empowering clients’ wealth journey with HUB24 Discover

Create opportunities for clients with less complex financial needs. HUB24 Discover, designed in conjunction with portfolio managers provides a streamlined selection of managed portfolios in a cost-effective platform and complements our Core and Choice offer.

Grow the SMSF market with HUB24 SMSF Access

HUB24 SMSF Access is a cost-effective solution designed to meet the needs of clients who want to experience the benefits of their own SMSF without the associated costs and administration complexity of establishing and managing a traditional SMSF.

Enhance the value of your advice and empower your high-net-worth clients

Meet the complex needs of the important and growing HNW segment, by leveraging HUB24’s extensive range of capabilities such as uncapped term deposits, foreign currency trading, third-party payment requests and over-the-counter (OTC) bond trading.

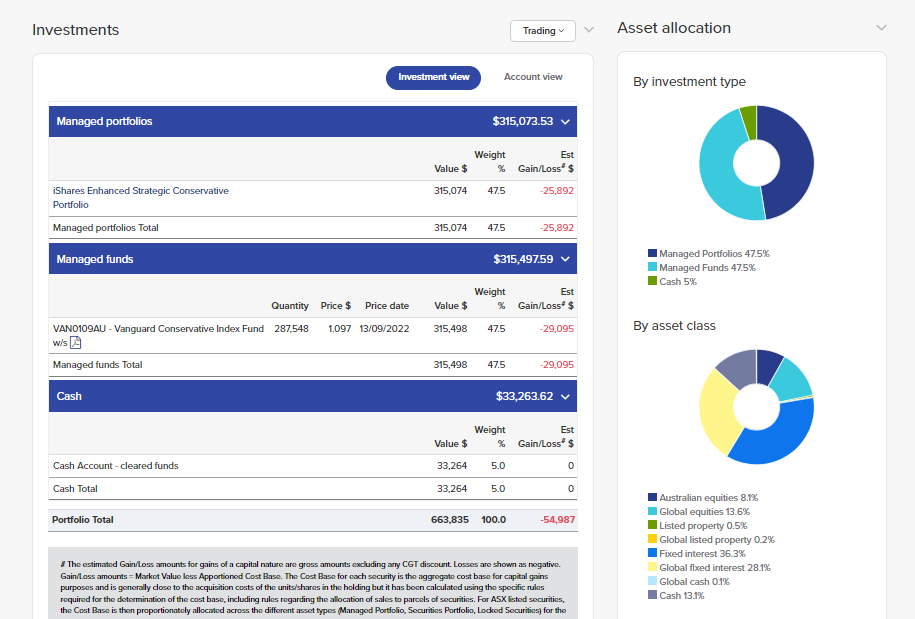

Provide a complete view of wealth with Engage

Save time and bring it all together. With our latest platform enhancements, you can include all of your clients’ investments in Engage, including automated data connections to select cash management or term deposit accounts.2

10 ways to drive productivity and reduce complexity for you and your clients

We’ve purpose-built our platform functionality to drive efficiencies for your business and your clients, such as online account opening with straight-through processing (STP), innovative digital advice fee consent tools and our flexible ROA generator.

- Perform in specie re-contributions without selling down or opening a new account, in as little as 5 business days.

- Add new client bank account details in real-time with our new secure Pay Anyone capability.

- Allocate new client contributions efficiently to underweight assets with Dynamic Asset Allocation.

- Save time preparing for client meetings by generating interactive and downloadable client presentations with just a few clicks via HUB24 Present.

- Enhanced processing times with same-day withdrawals for super benefit payments to help ensure clients can access their super benefit payments when most needed.3

- Save time with enhanced self-service capabilities when managing Rollover In requests, Notice of Intent (NOI) and online account opening processes.

- Personalised ROA generation for individual and bulk trading, plus model portfolios.

- Greater flexibility and choice when submitting request forms through our range of accepted leading e-signature providers such as myprosperity, Docusign, AdobeSign and Annature.

- Streamlined the account transition process into one place when tracking super to pension, pension refresh and re-contributions strategy requests.

- Save on average 23 hours pre typical work week when using managed accounts on the award-winning HUB24 platform.4

Broad investment choice

Our wrap investment menu offers a broad range of managed portfolios, managed funds, ASX listed securities, international listed securities, term deposits, annuities and more. Our investment menus are constantly evolving to ensure we meet the changing needs of your clients. We understand that every client is different, so we’ve created three investment menus to choose from.

Innovative managed portfolio functionality

Making things easy for you and your clients is at the core of everything we do. That’s why our managed portfolio functionality can help reduce the administration and compliance burden of managing multiple clients and drive better investment outcomes for their portfolios.

Our leading tax optimisation capabilities gives you the ability to manage capital gains tax (CGT) implications when rebalancing, trade netting capabilities to reduce unnecessary trading costs while our stock substitution functionality tailors your clients’ portfolios based on their needs.5

Connect with Australia’s Best Support whenever you need it4

BDMs

Rated Best BDM Support by advisers, our local State Managers and Business Development Managers are on hand to get you started with HUB24 and keep you moving forward.6

TRMs

Our Training and Relationship Managers are here to help set up your practice on the HUB24 platform, train your staff and identify key capabilities to get the most out of the HUB24 platform.

Business Enablement team

Our experienced Business Enablement Team of specialist project managers and consultants work closely with you, providing guidance and support through your transition process.

Customer service team

Our Australian based call centre staff are available whenever and however you want – through phone, email and online chat.

SupportHUB

Our online SupportHUB service centre is available 24/7. You can search for answers to key questions, electronically submit a service request and track its progress to resolution.

Innovative managed portfolios

Innovative managed portfolios empowering advisers and delivering value for clients.

Investments

Choose from a broad range of investment and insurance options available on HUB24 Invest.

Superannuation

Choose from a broad range of investment options to build your retirement savings with HUB24 Super.

Insurance

Connecting you to a broad range of market-leading insurance providers.

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

1 HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

2 Automated data connections are now available for Macquarie Cash Management Accounts, Macquarie Cash Management Accelerator Accounts and Macquarie Term Deposits. The Macquarie Cash Management Account, Macquarie Cash Management Accelerator Account and Macquarie Term Deposits are deposit products issued by Macquarie Bank Limited ABN 46 008 583 542 AFSL 237502. For Australian managed funds, Australian and internationally listed securities, the values are automatically updated by applying the latest closing price to the quantity input by the adviser.

3 Same-day super benefits payments withdrawals only apply for requests submitted before 1:00PM Sydney Time.

4 2025 SPDR ETFs/Investment Trends Managed Accounts Report.

5 Advisers rated us #1 for tax optimisation tools in the 2025 Investment Trends Adviser Technology Needs Report.

6 HUB24 was ranked #1 in Overall Satisfaction, Platform Offering, Reporting/Communication, BDM Support, Brand Image and Reputation and IT/Web Functionality in the 2024 Wealth Insights Service Level Report.