Save time. Bring it all together.

Give your clients a complete view of their wealth with interactive client presentations on HUB24.

Create a complete view of wealth for your clients.

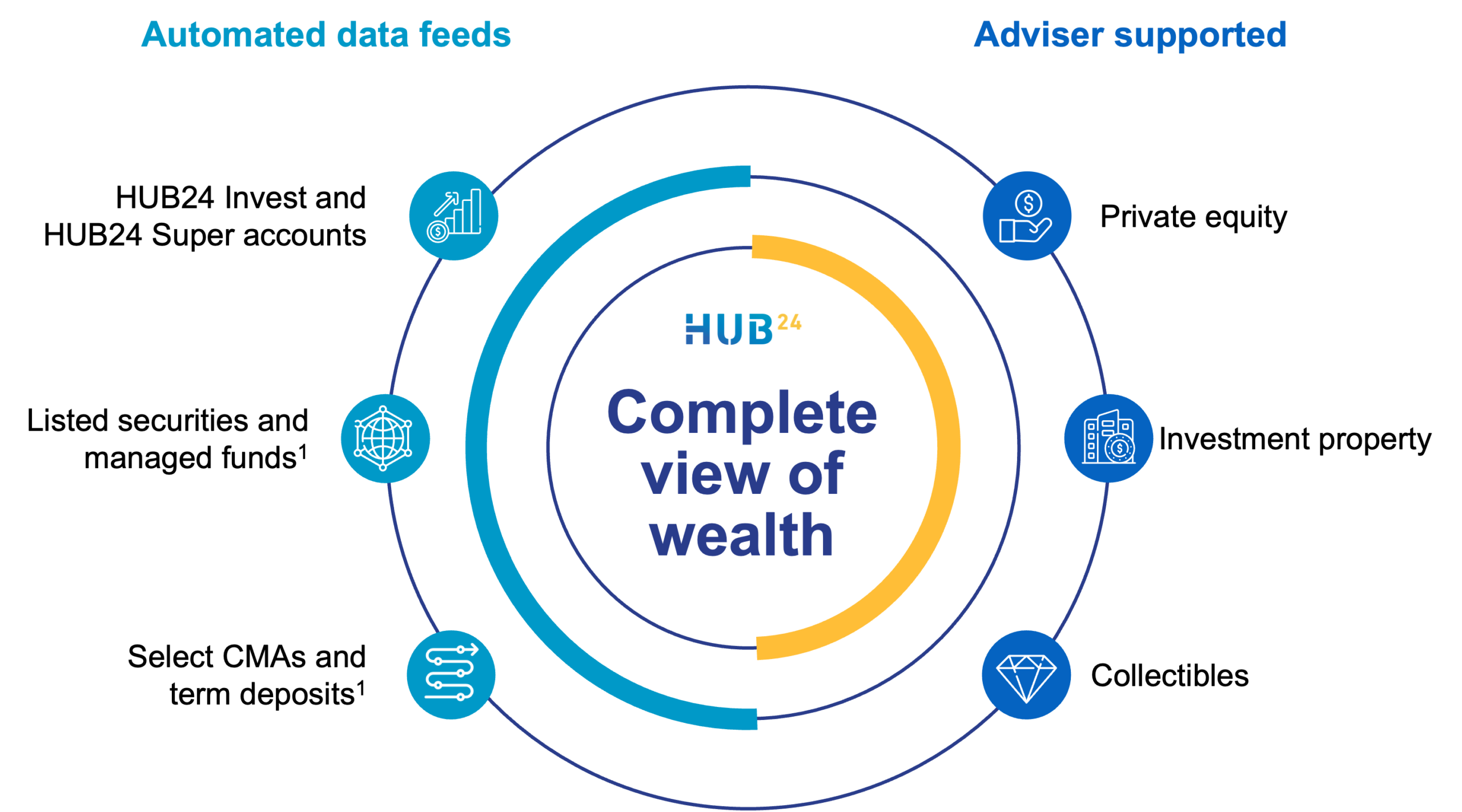

With our latest innovative platform enhancements, you can include all of your clients’ investments in HUB24 Present and our mobile app, including new automated data connections to select cash management or term deposit accounts.1

Bring together information about your clients’ HUB24 Invest and HUB24 Super accounts in holistic asset allocation discussions including their investments held off-platform. Values for listed securities and managed funds are also automatically updated based on the quantities you input to the platform.1

Add private equity, investment property or collectibles – with flexibility to update values as needed based on discussions with your clients.

Giving your clients a clear picture of their assets? We’ve made it easy.

HUB24 makes it easy to create a top-down view of your client’s assets, whether held in a HUB24 account or externally, under advice or not – to support meaningful conversations about the complete picture. With our interactive client presentation feature, HUB24 Present, you can:

Instantly access simple yet compelling presentations to tell the investment story in client meetings.

Use consistent language for asset allocation that your clients understand.

Have flexibility with performance calculations, choose before or after fees, include franking credits and compare returns against benchmarks.

Consolidate data for selected accounts across one or more client entities.

Automatically update the balances for Australian shares, international shares and select cash or term deposit accounts held outside of HUB24.1

Include or exclude your clients’ other investments held outside HUB24 for asset allocation.

Present live or download as a PDF or Excel to share directly with your clients.

Save on printing with drill down data on hand, such as contribution transactions, ready to answer unexpected questions.

Let’s talk about how Australia’s best platform can help you.

“The amount of time it takes for us to complete and prepare a report has been reduced by a few hours in some cases.”

Nicholas Emery, Arrow Private Wealth

Don’t just take our word for it. We’ve been rated #1 by advisers, Investment Trends and Wealth Insights.2,3,4

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

1 Automated data connections are now available for Macquarie Cash Management Accounts, Macquarie Cash Management Accelerator Accounts and Macquarie Term Deposits. The Macquarie Cash Management Account, Macquarie Cash Management Accelerator Account and Macquarie Term Deposits are deposit products issued by Macquarie Bank Limited ABN 46 008 583 542 AFSL 237502. For Australian managed funds, Australian and internationally listed securities, the values are automatically updated by applying the latest closing price to the quantity input by the adviser.

2 HUB24 was rated Best Platform Overall, Best Client Experience, Best Adviser Experience, Best Ease of Onboarding, Best Overall Functionality, Best Overall Investment Options, Best BDM Support and Best Online/ Call Centre Support in the 2024 Australian Financial Advice Landscape Report.

3 HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

4 HUB24 was ranked #1 in Overall Satisfaction, Platform Offering, Reporting/Communication, BDM Support, Brand Image and Reputation and IT/Web Functionality in the 2024 Wealth Insights Service Level Report.