The introduction of managed portfolios is assisting advisers meet Best Interests Duty and delivering customer benefits such as tax optimisation and efficient rebalancing which reduce transaction fees, but they are also adding practice value, measured by practice profitability and EBIT multiples.

According to Forte Asset Solutions’ Managing Director Steve Prendeville, this is because of the transformational influence the introduction of managed portfolios has on a advice practice, which triggers other beneficial changes to a practice such as:

- the review of pricing models,

- a refinement of the CVP,

- better technologies for efficient processes,

- corporate governance and

- compliance

“Businesses are forever changed with the introduction of managed portfolios,” said Prendeville. “This is an 18-month journey where risk factors are reduced.”

Participating in a HUB24 Webinar titled ‘Unlocking Practice value via Managed portfolios – how much value do they really add?’ Prendeville said every advice business he has worked with that has introduced managed portfolios has increased its profitability.

Further, while the extent of this impact cannot be generalised, he estimated the uplift to be a 30 per cent increase in profitability.

From a business sale perspective, this adds to the value of the business.

“Some buyers want a renovator’s delight, but others want the work done,” said Prendeville. “These businesses have increased profit, deeper client engagement and have re-engineered their businesses so there are not so many discount factors so the multiple being applied to these businesses is higher.”

If practices are considering moving to managed portfolios, Prendeville said they should consider:

- Running a tender for the platform and an asset manager if that is their investment model.

- Executing the plan with maximum communication with staff as well as service providers to troubleshoot any implementation issues.

- How they will address the challenges associated with change management.

While it is common for practices to use consultants, practices should expect it is common for 40% of FUM to transfer to managed portfolios in the first year, with 70% moving over after 18 months.

“You should sit down and consider what will the business look like in three years and then plan for it,” said Prendeville. “You can’t maintain the status quo and expect things to change.”

Did you miss our Webinar?

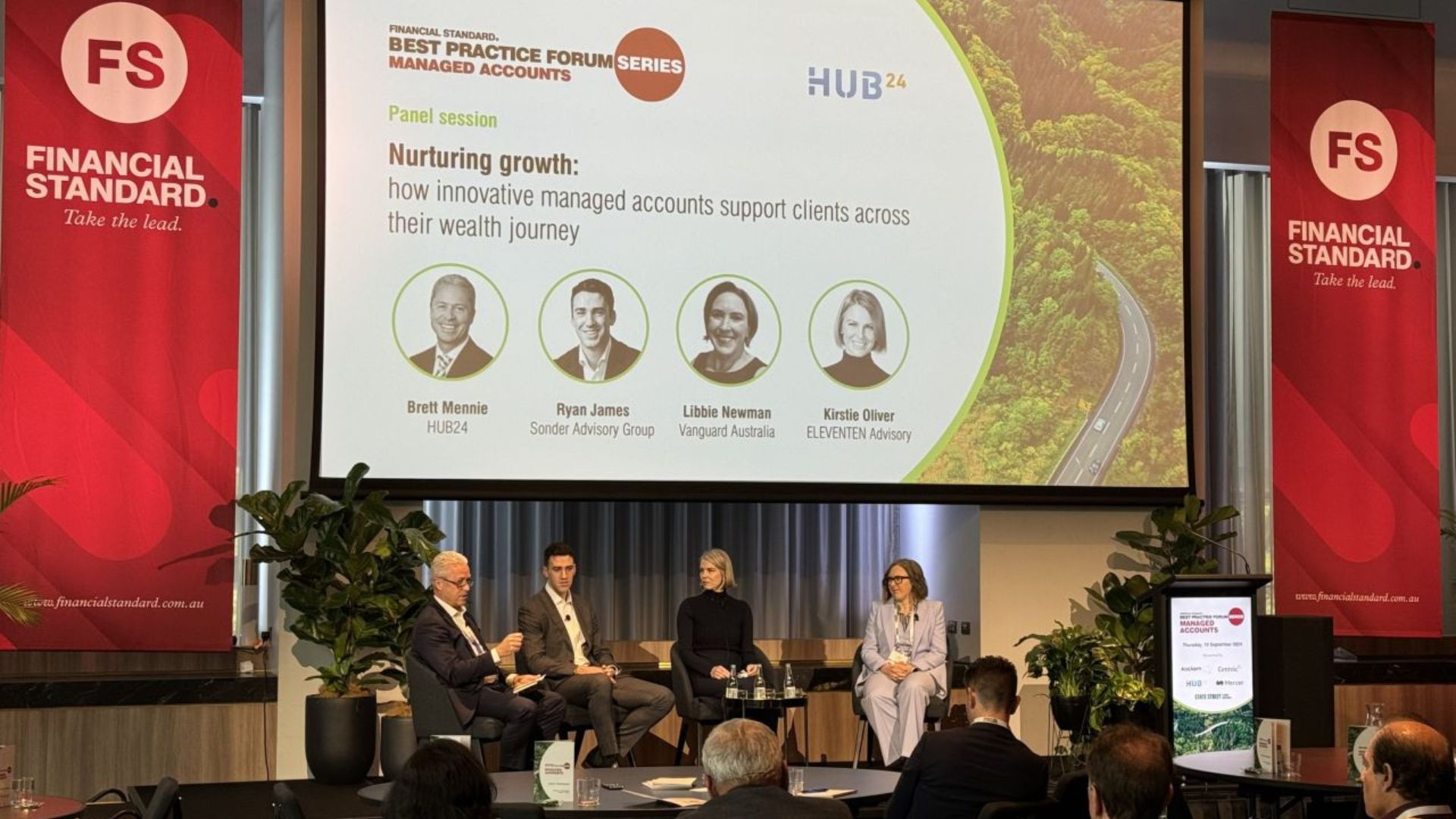

HUB24 Head of Managed Portfolios Brett Mennie discusses with Forte Asset Solutions’ Managing Director Steve Prendeville the positive impact of managed portfolios on practice valuations and bottom line and if indeed practices that use them are valued more favourably.

Using real case examples, Steve explains what he is seeing play out in today’s changing and dynamic marketplace, the proof points that matter when considering transitioning to a managed portfolio structure and indeed the sale price of your practice in the future.