TownsendCobain Private Wealth Partners who “lives and dies by the client experience” turned to managed portfolios to not only improve its investment administration but also because of its total commitment to improve the outcome for the client.

Speaking at a recent HUB24 Webinar titled ‘Using managed portfolios to deliver better outcomes to clients during market volatility,’ Principal Tim Townsend told advisers three years ago his business embarked on a business transformation that involved the integration of managed accounts.

“We had always been a big believer in bringing the best advice to all clients not just a few.”

However, Townsend said the reality was existing investment implementation using traditional managed portfolios, meant rolling out an investment approach over a 12-month period which was invariably out of date as time went on.

“Your top five clients are looked after and everyone else is left on the battlefield and that actually leaves you with a deep sense of guilt.”

He added: “There was this constant feeling of leaving clients behind and this is never more so than in the environment we are in today.”

While the current change in investment conditions is not Townsend’s “first rodeo”, there is always the same feeling when markets change, that the business cannot act quickly, decisively, and effectively enough across all its clients.

“Our looking at our investment management structure has allowed us to implement some changes.”

The first step in this journey was talking with his business partner Rod Cobain to reconfirm their philosophy and what they wanted managed accounts to deliver.

“While at the end of the day this is a technology issue, if you are delivering the wrong outcome it will just empower more of the wrong stuff.”

For TownsendCobain, its philosophy was to refocus its energies on the client experience and to oversee the investment approach.

“We were looking for a strategic partner who lives and breathes the markets while we live and breath the client experience with an overview of the markets.” This required us to seek an additional party to support our development and ongoing management of our Managed Accounts.

Managed portfolios enabled the business to not only tailor client portfolios but also to engage with them on issues such as ethical matters, which not only empowered the clients but provided another opportunity for engagement.

Dividing client portfolios into three buckets – two Separately Managed Accounts, Defensive & Growth and a Cash & Term Deposit bucket – provided a robust and communicable investment model for the business which could now live its principle of avoiding selling good quality assets when they are cheap.

“The structure allows us to ensure people’s cashflow is being managed, which positions them to not be a forced seller of assets.”

Did you miss our Webinar?

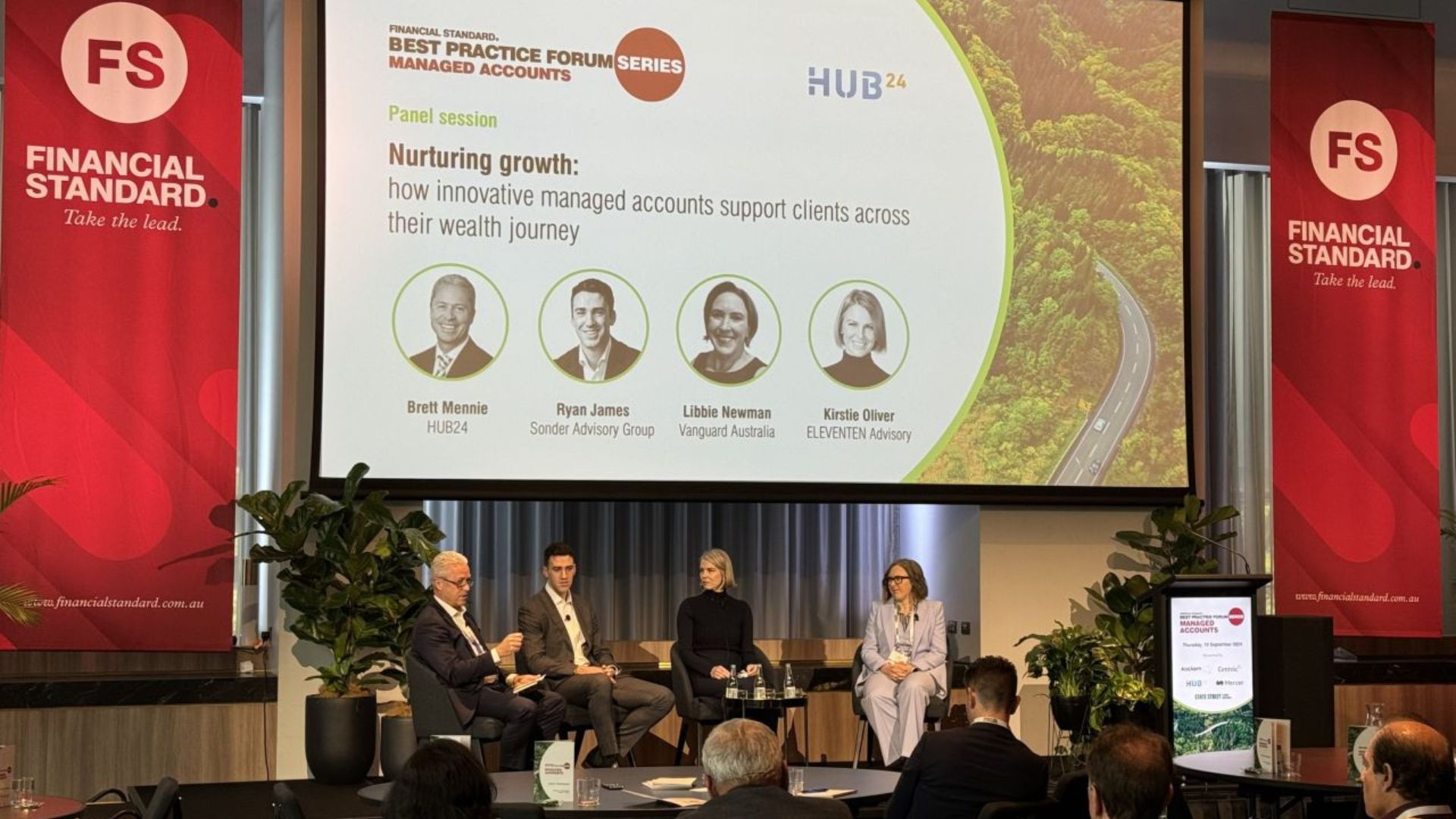

Challenging market conditions has advice practices looking to extract all value from managed portfolios. Tim Townsend from TownsendCobain Private Wealth Partners tells HUB24’s Head of Managed Portfolios Brett Mennie how his practice is using managed portfolios to help them respond, communicate, manage and guide their clients with confidence, through these unprecedented times.