HUB24 Non-Custodial

Service

Innovation that delivers non-custodial administration for your clients

Keep track of all your investments in one place

At HUB24, we understand the importance of having complete oversight of all your clients’ investments to enable informed decisions. The HUB24 Non-Custodial Service, together with HUB24 Invest, empowers you and your clients to conveniently manage and keep track of all their investments in one secure place.

Accessed via a client’s HUB24 Invest – Choice account, this solution provides you and your clients with comprehensive administration and integrated reporting for all their investments, allowing you to easily stay up to date.

How does the HUB24 Non-Custodial Service work?

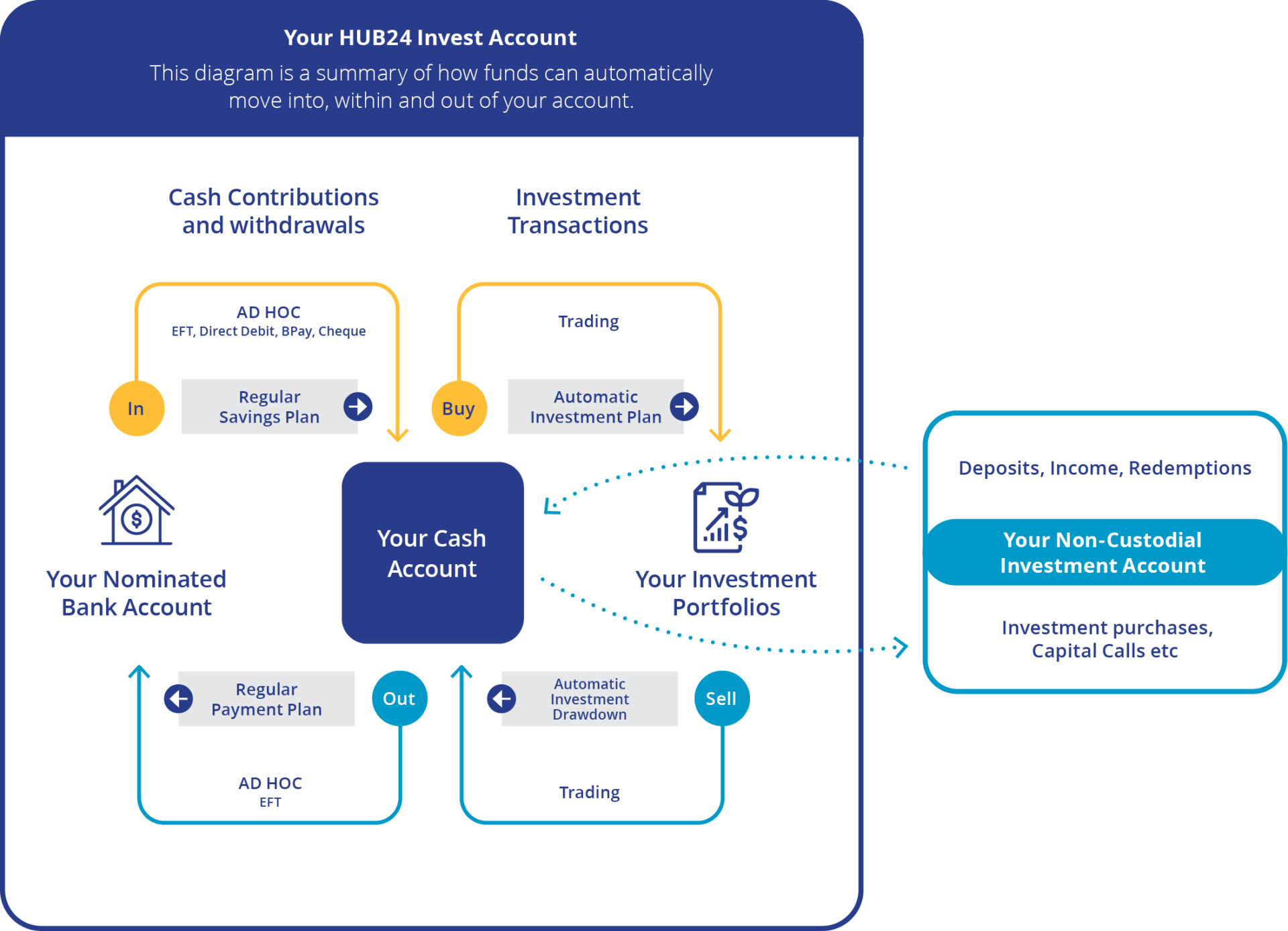

Expands your client’s HUB24 Invest account with administrative services for eligible investments they hold directly.1,2

Your client’s HUB24 Invest cash account is the central place to manage all fee payments and transactions. It’s also the main cash account for non-custodial product issuers, registries and fund managers.2

Interactive consolidated reporting. With Engage, you can provide a complete view of your client’s wealth and engage with their investment information.

Secure online access for your client through InvestorHUB.

Why choose HUB24?

HUB24 Limited is an ASX 100 listed company that leads the wealth industry as the best provider of integrated platform, technology and data solutions. Our platform is recognised by financial advisers and the wealth industry as Australia’s best platform and administers over $100 billion, with over $20 billion additional in non-custodial assets administered.3,4,5

We’re creating Australia’s Best Platform, together

We believe in the value of advice and enabling accessible financial advice to more Australians.

Simplify managing your client’s investments

By streaming administration and reporting, HUB24 Non-Custodial Service provides your clients with a range of benefits:

Extensive investment menu. With the HUB24 Non-Custodial Service together with HUB24 Invest, access a broader investment range to meet your clients’ objectives. Through the HUB24 Non-Custodial Service, you can specifically access alternative investments—such as private credit, private equity and private infrastructure.

Efficiency. Manage your clients’ assets in a single place, reducing the administrative burden of managing their investments.

Convenience. Your clients can have 24-hour online access to their investments via InvestorHUB, a secure online portal.

Access comprehensive reporting and a holistic view of wealth. Engage with a transparent view of your clients’ investments.

Broad investment range offering more choice

HUB24 Invest – Choice

Access a wide range of investments on the HUB24 platform, including:

- Managed funds,

- Managed portfolios,

- Australian and international listed securities,

- Term deposits,

- Longevity products,

- Foreign currency,

- Unlisted domestic fixed income securities,

- Cash, and

- Other investments made available by HUB24.

HUB24 Non-Custodial Service

There is a broad range of eligible assets that can be administered under the HUB24 Non-Custodial Service, including:

- Unregistered investment syndicates,

- Managed investment schemes or products not accessible via HUB24 Invest – Choice,

- Alternative investment structures,

- Listed securities on overseas exchanges not currently approved in HUB24 Invest – Choice, and

- Other eligible assets if approved by HUB24 upon request.

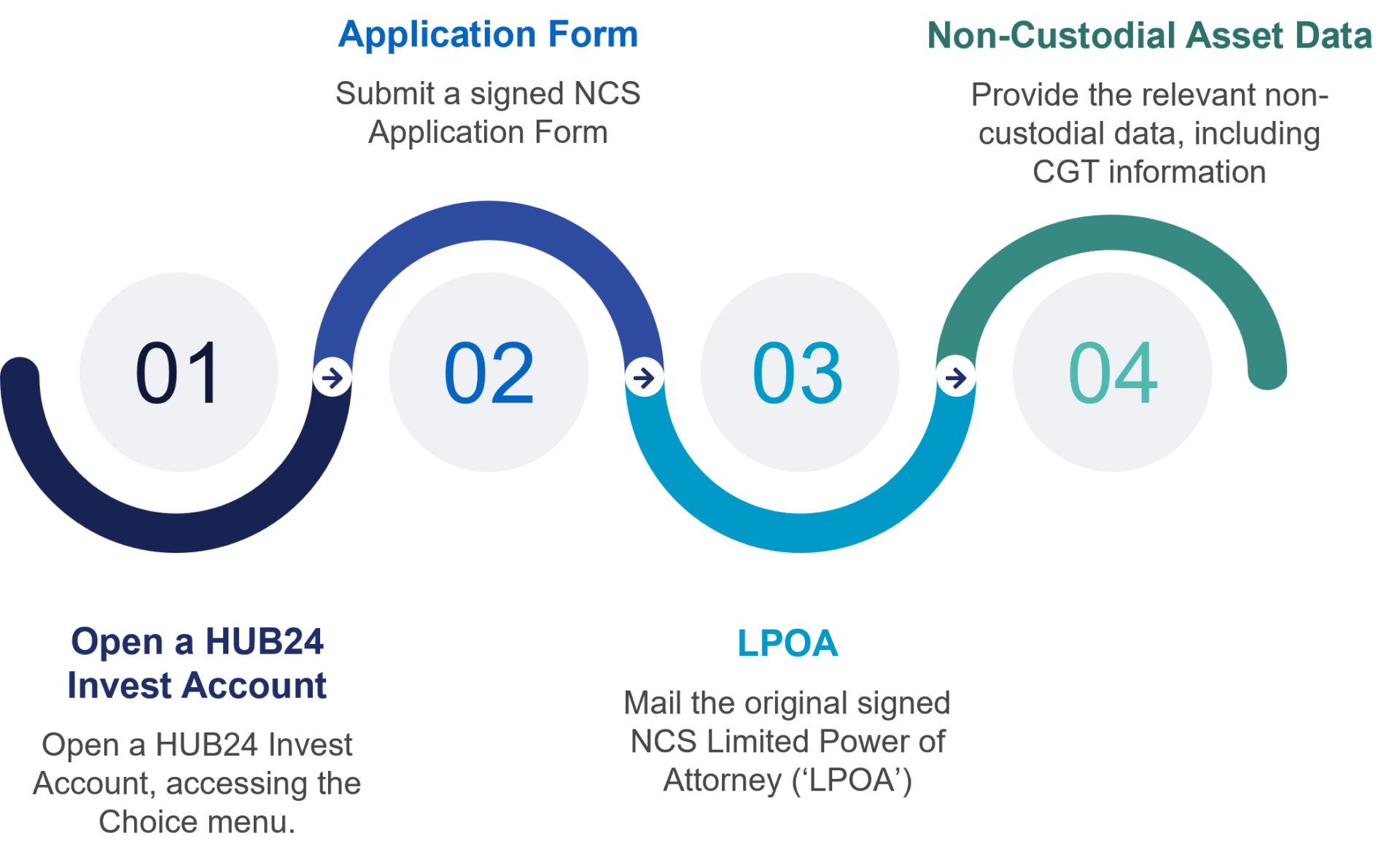

Four steps to open a HUB24 Non-Custodial Service account

Frequently Asked Questions

The cash account minimum that applies to HUB24 Invest is disclosed in the HU24 Invest IDPS Guide and does not change with the launch of the HUB24 Non-Custodial Service. For more information, see the latest HUB24 Invest PDS available here.

Yes, the HUB24 Non-Custodial Service is only available to clients with a financial adviser. Once you have an adviser, our Client Service team can liaise with them to discuss any investment instructions, which saves you time.

Want to learn more about the HUB24 Non-Custodial Service?

Discover how the HUB24 Non-Custodial Service can empower your clients to keep track of all their investments in one place. Whether you’re a financial adviser or an advised client, we’ve made it simple to take the next step.

For advisers

Connect with your local BDM to learn more about how the HUB24 Non-Custodial Service together with HUB24 Invest, can empower your clients.

For advised clients

Speak with your financial adviser today and explore how the HUB24 Non-Custodial Service together with HUB24 Invest can fit into your wealth strategy.

1 May include eligible investments your clients hold directly or those held by an external custodian.

2 HUB24 Invest account number required for the HUB24 Non-Custodial Service application form.

3 HUB24 was rated Best Platform Overall in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

4 HUB24 platform Funds Under Administration (FUA) as at 30 September 2025.

5 HUB24 Portfolio, Administration and Reporting Services (PARS) Funds Under Administration (FUA) as at 30 September 2025.