Retirement Income Strategy Education and Tools

As superannuation becomes the primary income source for many retirees, it’s important to create a plan that not only maximises the growth of your super during your working life but also ensures a stable income stream when you retire. While there are several key factors to consider—such as choosing the right investment options, setting appropriate withdrawal rates, understanding tax implications, and factoring in government benefits—working with a financial adviser can help you navigate these decisions more effectively. With expert guidance, you can protect your financial future and maintain the lifestyle you want in retirement. To help you get started, we’ve compiled some valuable government resources to support you in reaching these goals.

How much you will have when you retire

It’s important to consider how you are tracking towards your retirement goals. The moneysmart retirement planner can help you work out:

- what income you’re likely to get from super and the age pension when you retire

- how contributions, investment options, fees and retirement age affect your retirement income

- how working part-time or taking a break from work affects your super balance

Help your super grow

Understanding how to manage your super, can help you reduce the fees you pay and grow your super faster. Here are some ways to manage your super:

Accessing your super

You can access your super when you retire and reach your ‘preservation age’. This is between 55 and 60, depending on when you were born. Or when you reach age 65, even if you are still working. Here are some resources to help you through this process:

Financial advice

A good financial adviser gets to know you. They work with you to set your financial goals and make a plan to help you achieve them.

Take the time to compare different advisers. Knowing what to expect can make all the difference. Here are some resources to help you through this process:

- Choosing a financial adviser

- Working with a financial adviser

- Financial advice costs

- Financial advisers register

HUB24 Super Fund is designed for use with an adviser who is authorised to use the HUB24 platform. Your new adviser can confirm if they are authorised to use the HUB24 platform.

Please contact us if you would like help finding an adviser near you, who is registered to use the HUB24 platform.

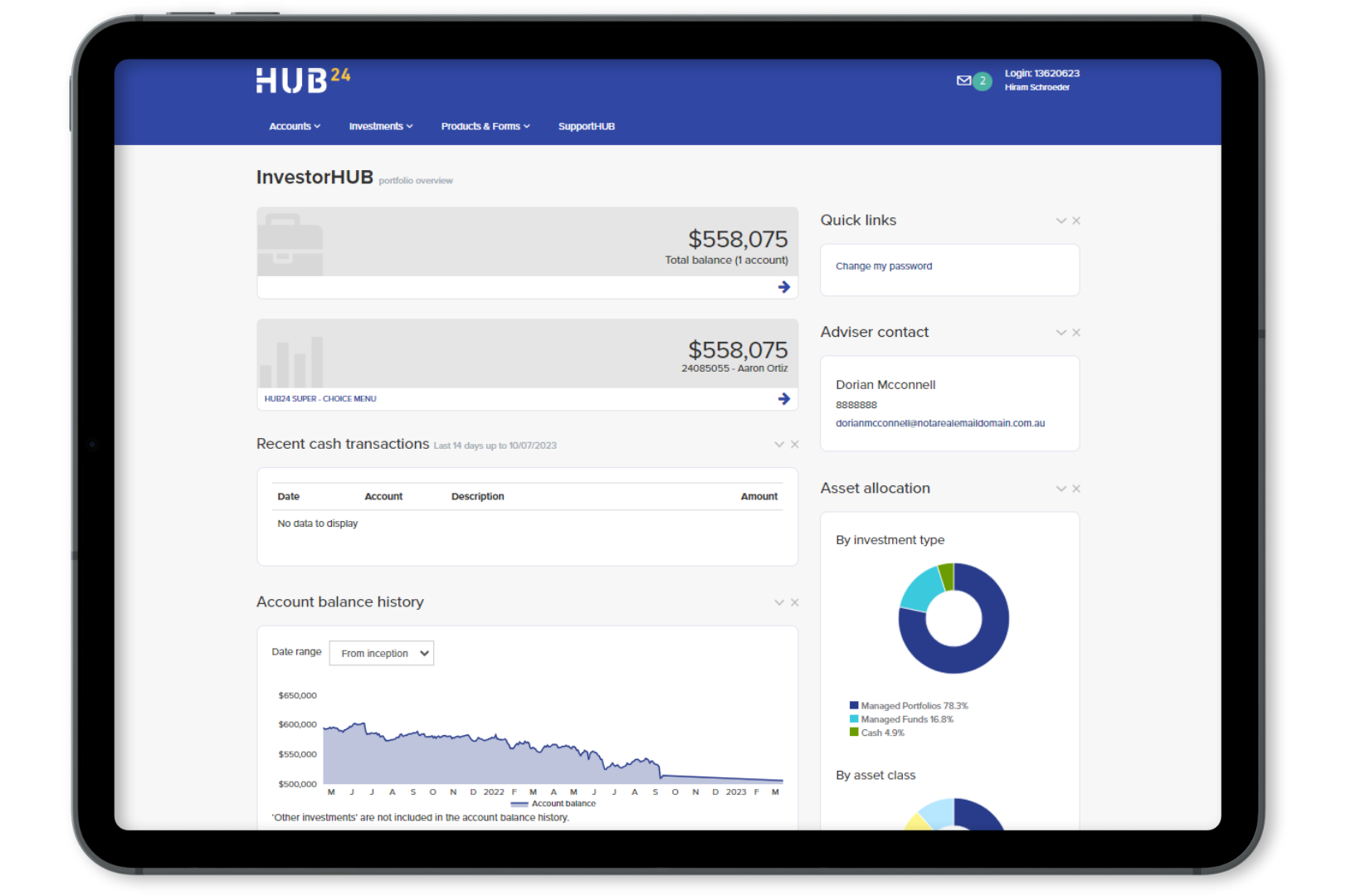

Accessing your account via InvestorHUB

Our client portal, InvestorHUB, empowers you to stay connected, and take better control of your investments – all in one place.

You can:

- view details of your account holdings, including asset allocation

- access a full list of investment options including up-to-date valuations and performance graphs

- view important notifications

- buy and sell investments

- update your contact details

- download all reports including your Annual Statement

- Access forms to manage your account

Access InvestorHUB via your desktop or mobile browser. You can also download our free mobile app via the Apple App Store or Google Play store.

Contacting HUB24

Contact us online via our form

Chat to our customer service team