HUB24 Private Invest

Innovation that delivers flexibility for high-net-worth investors

Access a complete view of your wealth all in one place

Access a broad range of investment options through HUB24 Private Invest, designed to provide choice and flexibility to suit the needs of advised high-net-worth clients. HUB24 Private Invest provides a complete view of wealth, empowering advised wholesale clients to make informed decisions about their portfolios.

HUB24 Private Invest includes your investments on the HUB24 platform and the administration of your assets held directly through our non-custodial service – bringing the administration of all your assets together to save you time and provide you with a single place to manage all your investments.

How does HUB24 Private Invest work?

One central place to manage all investments

Combines investments held by HUB24 and directly by you

Easy account setup – one application and disclosure document

One portal with consolidated, interactive reporting

Why choose HUB24?

HUB24 Limited is an ASX 100 listed company that leads the wealth industry as the best provider of integrated platform, technology and data solutions. Our platform is recognised by financial advisers and the wealth industry as Australia’s best platform and administers over $136.4 billion .1, 2

We’re creating Australia’s Best Platform, together

We believe in the value of advice and enabling accessible financial advice to more Australians.

Managing your investments your way

With flexibility designed just for you, HUB24 Private Invest provides a range of benefits:

Broad investment menus offering more choice for high-net-worth investors

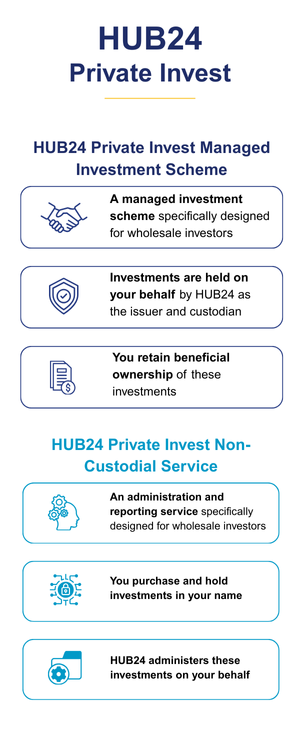

HUB24 Private Invest Managed Investment Scheme

Access a wide range of investments on the HUB24 platform, including:

- Managed funds

- Managed portfolios

- Australian and international listed securities

- Term deposits

- Longevity products

- Foreign currency

- Unlisted domestic fixed income securities

- Cash and

- Other investments made available by HUB24

HUB24 Private Invest Non-Custodial Service

There is a broad range of eligible assets that can be administered under the HUB24 Private Invest Non-Custodial Service, including:

- Unregistered investment syndicates

- Managed investment schemes or products not accessible via the HUB24 Private Invest Managed Investment Scheme

- Alternative investment structures

- Listed securities on overseas exchanges not currently approved in the HUB24 Private Invest Managed Investment Scheme, and

- Other eligible assets if approved by HUB24 upon request.

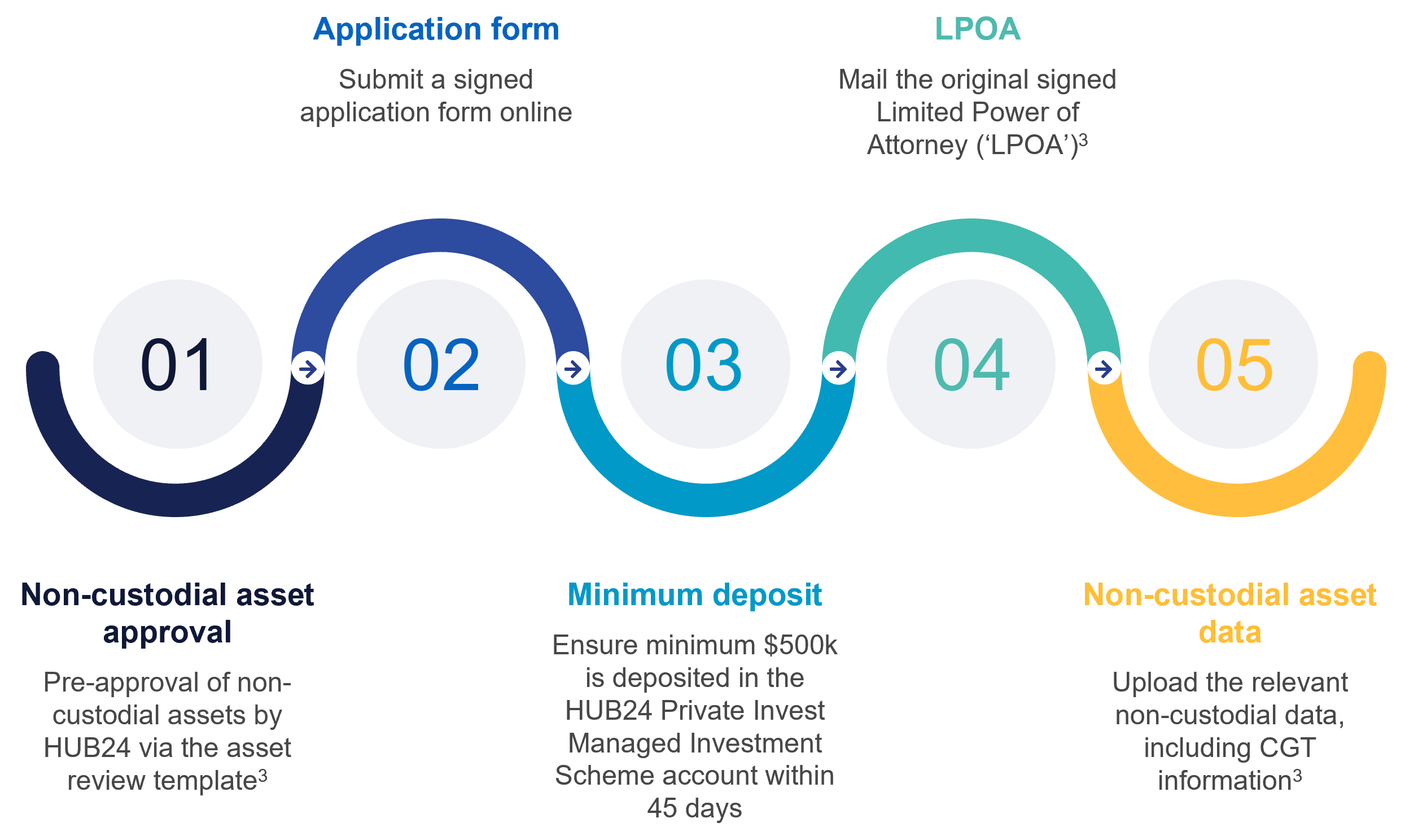

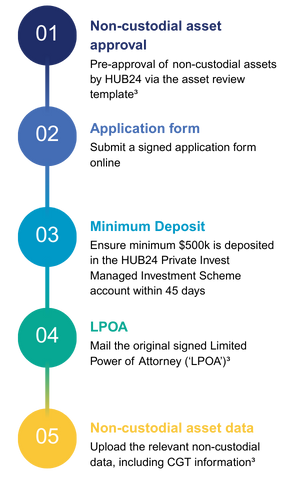

Five steps to open your HUB24 Private Invest Account

Establish your HUB24 Private Invest Account online through a single application that includes your investments in the HUB24 Private Invest Managed Investment Scheme and the HUB24 Private Invest Non-Custodial Service.

HUB24 Private Invest documents

Frequently asked questions

HUB24 Private Invest is available for wholesale investors, including individuals over 18 years of age, associations, companies, trustees of trusts, or trustees of self-managed super funds. Each wholesale investor must deposit a minimum of $500,000 within 45 days of opening a HUB24 Private Invest Managed Investment Scheme account. Joint investors must individually qualify (for example, a minimum of $1,000,000 must be contributed where there are two joint investors).

If the minimum deposit is not received within the 45-day period, then HUB24 is required to take steps to close an investor’s Scheme account, including selling down any assets.

1 HUB24 was rated Best Platform Overall in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

2 Total Funds Under Administration (FUA) as at 30 June 2025, includes Platform FUA and Portfolio, Administration and Reporting Services (PARS) FUA.

3 For the HUB24 Private Invest Non-Custodial Service only, which is optional.